Managing insurance claims can feel overwhelming, especially when you’re dealing with medical emergencies or health-related expenses. Whether you’re a policyholder trying to get your claim approved or a healthcare provider managing multiple claims daily, understanding how efficient claims management works can save you time, money, and stress.

In this comprehensive guide, we’ll explore everything you need to know about efficient claims management, how it benefits you, and why choosing the right Third Party Administrator (TPA) makes all the difference in your insurance experience.

Understanding Claims Management in Insurance

Claims management refers to the entire process of handling insurance claims from the moment they’re filed until they’re settled. This includes receiving claim requests, verifying policy details, assessing coverage, processing documentation, and disbursing payments to the rightful parties.

The process involves multiple stakeholders including the insurance company, the policyholder, healthcare providers, and often a TPA that acts as an intermediary. When claims management works efficiently, everyone benefits – patients receive timely reimbursements, hospitals get paid faster, and insurance companies maintain smooth operations. However, when the process breaks down, it leads to frustration, delayed treatments, and financial strain.

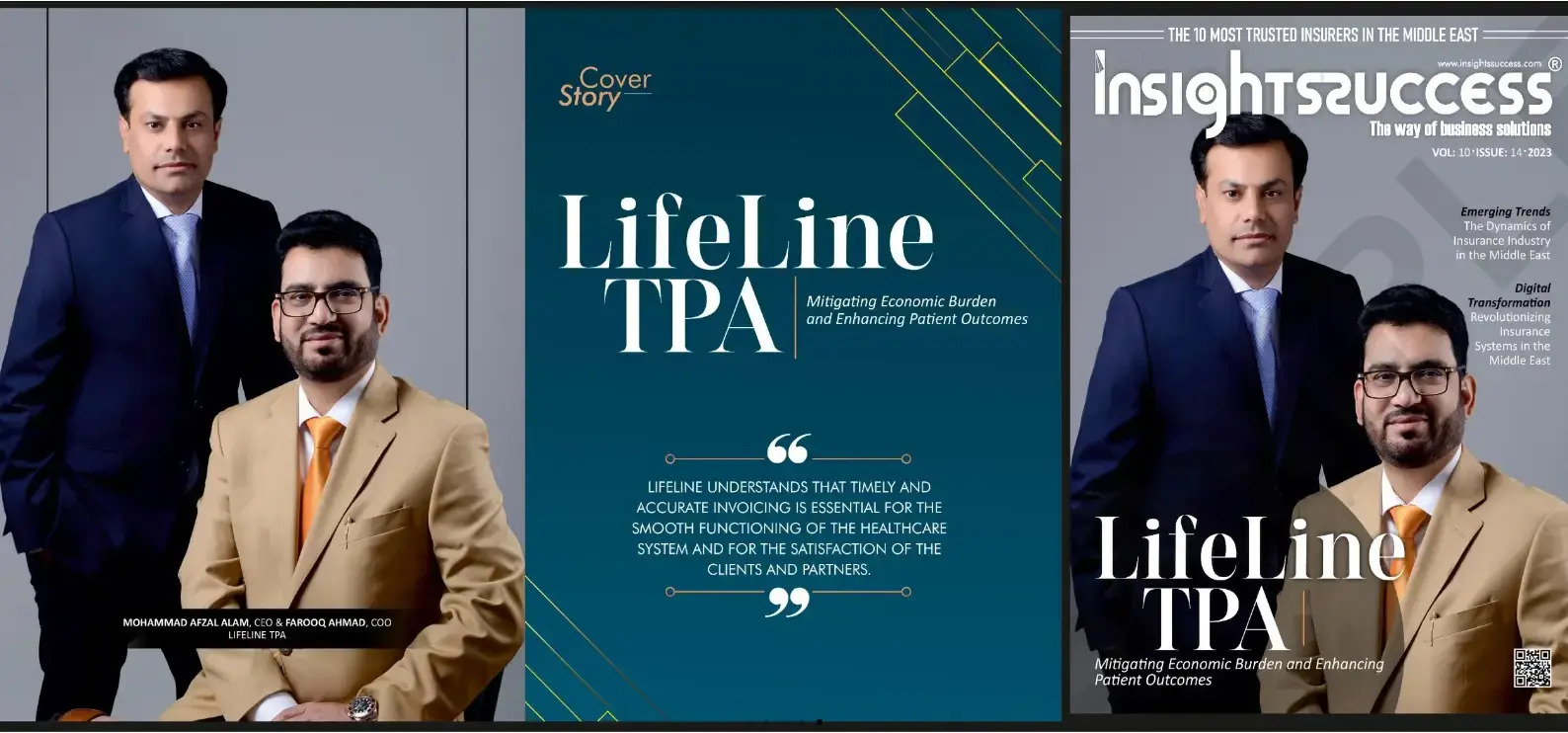

A well-structured claims management system ensures that every claim is handled fairly, accurately, and promptly. Lifeline TPA specializes in providing comprehensive claims management services that prioritize customer satisfaction while maintaining high standards of accuracy and compliance. Their experienced team understands the complexities of insurance claims and works diligently to ensure smooth processing for all parties involved.

Why Efficient Claims Management Matters

Time is often the most critical factor when dealing with health insurance claims. When you or a loved one needs medical treatment, waiting weeks for claim approval can create unnecessary stress and financial burden. This is where efficient claims management becomes essential.

Efficient claims management reduces processing time significantly. Instead of waiting for 30 to 45 days, claims can be processed within 7 to 15 days when handled by competent professionals. This quick turnaround means you can focus on recovery rather than worrying about paperwork and payments. Healthcare providers also appreciate faster processing as it improves their cash flow and reduces administrative overhead.

Beyond speed, efficient claims management also improves accuracy. Proper verification and documentation reduce the chances of claim rejection, which means fewer appeals and resubmissions. When your TPA maintains high standards of accuracy, you experience fewer hassles and get the coverage you’re entitled to without unnecessary complications.

Key Components of Effective Claims Processing

Efficient claims management relies on several critical components working together seamlessly. The first component is comprehensive documentation. Every claim needs proper supporting documents including hospital bills, prescription receipts, diagnostic reports, and policy documents. When these are organized and submitted correctly from the start, processing becomes much smoother.

The second component is thorough verification. Claims processors must verify policy validity, check coverage limits, confirm network hospital status, and ensure that the treatment falls within policy terms. This verification prevents fraudulent claims while protecting policyholders from unexpected denials. Advanced technology and experienced staff make this verification process both quick and accurate.

The third component is clear communication. Throughout the claims journey, all parties should know the status of their claim. Automated updates, dedicated support teams, and transparent processes ensure that no one is left wondering about their claim status. Good TPAs provide multiple channels for communication including phone, email, and online portals.

Technology’s Role in Modern Claims Management

Modern claims management has been revolutionized by technology. Digital platforms allow policyholders to submit claims online, upload documents through mobile apps, and track claim status in real-time. This eliminates the need for physical visits to offices and reduces processing time dramatically.

Artificial intelligence and machine learning algorithms can now review claims for accuracy, flag potential issues, and even predict approval likelihood. These systems can process vast amounts of data much faster than manual review, identifying patterns and anomalies that might be missed by human eyes. However, technology doesn’t replace human judgment – it enhances it by handling routine tasks and allowing experienced professionals to focus on complex cases.

Cloud-based systems also enable better collaboration between insurance companies, TPAs, and healthcare providers. When everyone can access the same information securely, coordination improves and bottlenecks are eliminated. This integrated approach is the future of claims management, making the entire ecosystem more efficient and user-friendly.

Common Challenges in Claims Management

Despite technological advances, claims management still faces several challenges. One major issue is incomplete documentation. Many claims get delayed or rejected simply because required documents are missing or unclear. Policyholders often don’t know exactly what documents they need, leading to multiple submission attempts and frustration.

Another challenge is policy interpretation. Insurance policies can be complex, with specific terms, conditions, and exclusions that aren’t always easy to understand. Disputes often arise when policyholders believe they’re covered for a treatment that the insurance company considers excluded. Clear policy communication and expert guidance can help prevent these misunderstandings.

Fraud is another significant concern in the insurance industry. Some individuals or providers may attempt to file false claims or inflate expenses, which ultimately affects premium costs for all policyholders. Robust verification processes and data analytics help identify suspicious patterns while ensuring legitimate claims aren’t unfairly denied.

Choosing the Right TPA for Your Needs

Selecting a competent TPA is crucial for hassle-free insurance experience. The right TPA should have a strong network of hospitals, ensuring you have access to quality healthcare facilities across your region. They should also have a proven track record of quick claim settlement and high approval rates.

Customer service quality is another important consideration. When you have questions or concerns about your claim, you need a responsive support team that can provide clear answers. Look for TPAs with multiple communication channels, extended support hours, and knowledgeable representatives who can guide you through the process.

Experience and reputation matter significantly in this industry. Established TPAs have refined their processes over years of operation, learning from challenges and continuously improving their services. They understand regulatory requirements, maintain good relationships with insurance companies and hospitals, and can navigate complex situations effectively.

Getting Help When You Need It

When you face issues with your insurance claims or need guidance on the claims process, having access to reliable support makes all the difference. Whether you’re unsure about documentation requirements, want to check your claim status, or need to resolve a dispute, expert assistance can resolve issues quickly.

Many people hesitate to reach out for help, assuming they’ll figure things out on their own. However, insurance claims can be complex, and professional guidance can save you significant time and prevent costly mistakes. Don’t let confusion or frustration derail your claim – reach out to experts who can clarify the process and advocate for your rights as a policyholder.

If you need assistance with your insurance claims or have questions about the process, lifeline insurance contact number provides direct access to experienced professionals who can help. Their team understands the challenges policyholders face and works diligently to ensure every claim receives proper attention and fair treatment.

The Future of Claims Management

The insurance industry continues to evolve, with claims management becoming increasingly sophisticated and customer-centric. Emerging technologies like blockchain promise even greater transparency and security in claims processing. Telemedicine integration is making it easier to file claims for virtual consultations, reflecting changing healthcare delivery models.

Personalization is another trend shaping the future of claims management. Advanced data analytics allow TPAs to understand individual policyholder needs and preferences, tailoring their services accordingly. This might include customized communication preferences, proactive claim assistance for chronic conditions, or simplified processes for routine claims.

Sustainability and paperless processing are also becoming priorities. Digital documentation not only speeds up processing but also reduces environmental impact. As more policyholders become comfortable with digital platforms, we can expect the entire claims ecosystem to become more efficient, accessible, and environmentally responsible.

Conclusion

Efficient claims management is the backbone of a positive insurance experience. When claims are processed quickly, accurately, and transparently, policyholders can focus on what truly matters – their health and wellbeing. Understanding how the process works, knowing what to expect, and partnering with competent professionals makes all the difference.

Whether you’re filing your first insurance claim or dealing with regular medical expenses, remember that you don’t have to navigate this journey alone. Quality TPAs combine technology, expertise, and genuine customer care to ensure your claims are handled with the attention and efficiency they deserve.

By staying informed about your policy, maintaining proper documentation, and choosing the right partners for claims management, you can transform what’s often seen as a stressful process into a smooth, hassle-free experience. The right support system ensures that when health challenges arise, financial concerns don’t add to your burden.